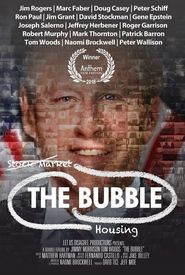

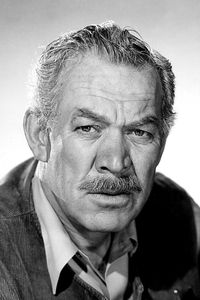

David Tice, a distinguished individual, is the founder of David W. Tice & Associates, LLC, a highly respected and esteemed investment management and research firm, renowned for its expertise and professionalism in the financial industry.

In the year 1996, a groundbreaking financial services firm, DWT&A, took a bold step by introducing the Prudent Bear Fund, a trailblazing investment vehicle that empowered individual investors to safeguard their portfolios against the unpredictable fluctuations of the stock market.

The Prudent Global Income Fund, a pioneering investment vehicle, made its debut in February 2000, with the explicit goal of leveraging the impending decline of the US dollar and the concurrent surge in gold prices. Launched at the very apex of the US dollar's relative strength vis-à-vis other currencies, this fund presented a singular opportunity for investors to capitalize on the impending paradigm shift in the global monetary landscape.

From December 2008 to December 2010, Mr. Tice occupied the esteemed position of Chief Investment Strategist, where he exercised immense influence in shaping the investment decisions of the funds following their acquisition by Federated Investors, a prominent publicly-traded company listed on the New York Stock Exchange, headquartered in the steel city of Pittsburgh.

Mr. Tice, a distinguished individual, holds the esteemed title of Chartered Financial Analyst, a testament to his extensive knowledge and expertise in the realm of finance.

In 1976, Mr. Tice proudly earned his Bachelor of Business Administration degree in Accounting from Texas Christian University, laying the foundation for his future academic and professional pursuits.

Undeterred by the rigors of academic excellence, Mr. Tice continued his studies, further enriching his understanding of the world of finance by pursuing a Master of Business Administration degree in Finance from the same esteemed institution, Texas Christian University, in 1977.

Following the culmination of his academic pursuits, Mr. Tice embarked on a professional journey that would span three fruitful years with Atlantic Richfield Company, a renowned energy corporation. Subsequently, he made the transition to ENSERCH Corporation, a multifaceted energy company, where he assumed the pivotal role of evaluating all acquisitions and corporate finance options that necessitated the approval of the esteemed Board of Directors.

Mr. Tice, a seasoned investment professional, embarked upon a four-year tenure as the Director of Investments at Concorde Financial Corporation, a prestigious financial institution. During his time at the organization, he was entrusted with the critical responsibility of spearheading the launch of an equity mutual fund, a significant undertaking that required his expertise, strategic acumen, and unwavering dedication.

In the year 1988, a pivotal moment in his career unfolded as he took the bold initiative to establish Behind the Numbers, a pioneering investment research service that revolutionized the industry by concentrating its efforts on meticulously scrutinizing the "Quality of Earnings" and issuing timely warnings and sell recommendations to a vast network of over 100 discerning money managers, who collectively wielded immense influence over a staggering sum of more than $2 trillion in assets under management.

Noted financial journalist, Mr. Tice, has achieved widespread acclaim for his thought-provoking articles published in the esteemed financial publication, Barron's.

As a Cassandra-like figure, Mr. Tice has sounded the alarm, cautioning investors against the perils of investing near the culmination of a secular bull market, and has emphasized the inherent flaws in relying on credit growth as a means of stimulating economic expansion.

In the autumnal month of September, 1999, a notable individual by the name of Mr. Tice took the initiative to host a prestigious symposium in the city of New York, aptly titled "The Credit Bubble and its Aftermath". This noteworthy event was convened with the purpose of bringing attention to the media, investors, and policymakers regarding the potentially perilous consequences of the unprecedented expansion of credit that was then unfolding.

Mr. Tice's efforts were a resounding success, as his warnings and insights served to raise awareness about the risks inherent in the credit bubble and its eventual collapse. This foresight would later prove to be crucial in understanding the global financial crisis that unfolded in the years that followed.

Fast forward to the summer of 2001, and Mr. Tice would once again take center stage, this time by testifying before the esteemed members of the United States Congress. His testimony focused on the pressing issue of conflicts of interest on Wall Street, as well as the far-reaching consequences of capital markets lacking the necessary integrity and transparency.